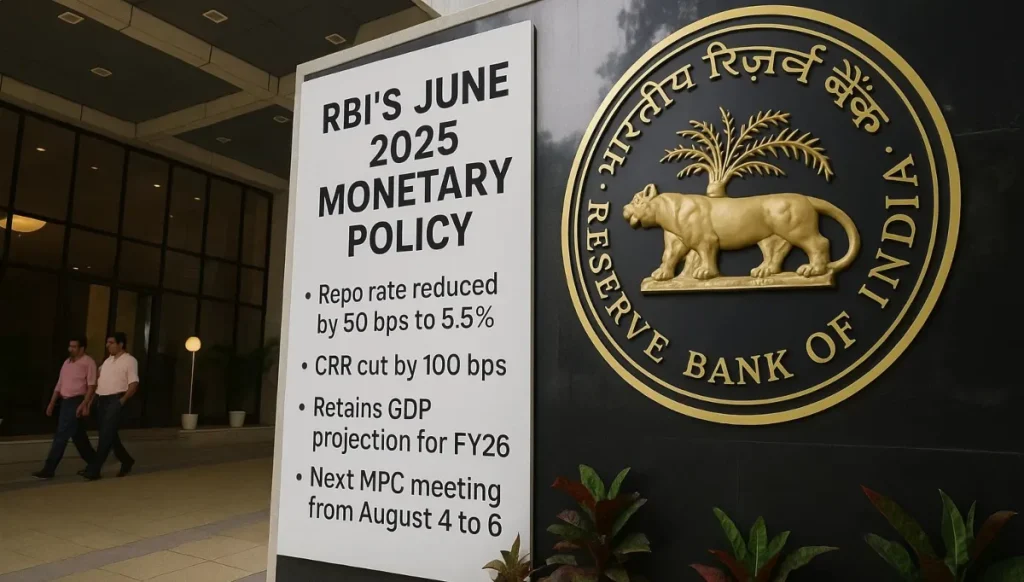

RBI’s 50 bps Repo Rate Cut: Impact on ₹50 Lakh Home Loan EMI Explained

In a move that has grabbed the attention of borrowers and financial planners alike, the Reserve Bank of India (RBI) has slashed the repo rate by 50 basis points. This might sound like a technical move best left to economists, but if you’re someone with a home loan—or thinking of getting one—this small percentage change can actually save you lakhs of rupees over time.

Let’s explore what this repo rate cut really means for you and how it affects your home loan EMI after repo rate cut.

First, What is the Repo Rate?

To put it simply, the repo rate is the interest rate at which the RBI lends money to commercial banks. When this rate goes down, banks can borrow money more cheaply, and ideally, they pass that benefit on to customers in the form of lower interest rates on loans.

So when the RBI reduces the repo rate, home loan borrowers stand to benefit—especially those on floating interest rate loans. These loans are often linked directly to the repo rate or the external benchmark rate, meaning any change in the repo rate reflects quickly in your EMI.

How Much Will My Home Loan EMI Drop?

Let’s take a practical example to understand this better. Suppose you have a ₹50 lakh home loan with a tenure of 20 years.

Before the Repo Rate Cut:

Let’s assume your loan is at a 9% interest rate. Your monthly EMI would be around ₹44,986. Over the full tenure of 20 years, you’d end up paying ₹57.96 lakh in interest alone—almost as much as the principal!

After a 50 bps (0.50%) Cut:

If your interest rate drops to 8.5% due to the repo rate cut, your EMI comes down to approximately ₹43,391. This may look like a small monthly saving, but over 20 years, this means you save ₹4.8 lakh in interest.

That’s a substantial amount, especially considering you didn’t have to do anything to earn it—just the RBI’s move working in your favor.

Does This Benefit Everyone?

Not necessarily. The repo rate cut benefits only those whose home loans are linked to floating interest rates, particularly repo-linked loans. If you took a fixed-rate loan, this cut won’t help unless you refinance or renegotiate your terms with the bank.

Also, some banks may delay passing on the full benefit. Public sector banks tend to respond faster, but private banks might take a while—or reduce only partially.

So it’s a good idea to check your loan agreement or speak to your lender to see how the rate cut affects your loan.

What Should You Do as a Home Loan Borrower?

If your loan is repo-linked, you might notice a change in your EMI in the next one or two billing cycles. If your loan isn’t repo-linked, you can ask your bank if you’re eligible for a conversion. Some banks allow switching from an older rate system (like MCLR or base rate) to a repo-linked rate for a small fee.

It’s also worth exploring loan refinancing options. If another bank is offering a better rate and your current lender is unwilling to negotiate, you could consider transferring your home loan. But always check the processing fees, legal charges, and foreclosure clauses before doing this.

Should You Reduce Tenure or EMI?

When interest rates drop, banks usually offer to lower your EMI. But if you can afford to pay the same EMI as before, ask your bank to reduce the tenure instead. This helps you close the loan faster and reduces your total interest outgo even more.

In the earlier example, keeping the EMI unchanged at ₹44,986 even after the rate cut could help you save nearly ₹6-7 lakh more over the full term, depending on how your bank recalculates the tenure.

Is It a Good Time to Take a Home Loan?

With interest rates heading downward, it can be a strategic time to take a home loan—especially if you’re planning to buy a property. Lower EMIs make long-term commitments more manageable, and if the property is under construction, you have the flexibility of a phased disbursal.

However, interest rates may not stay low forever. So if you’re taking a floating-rate loan, be prepared for future fluctuations. Consider a financial cushion in your budget so you’re not caught off guard when rates go up again.

Final Thoughts

A 50 bps repo rate cut might seem like a tiny tweak, but for borrowers, it could mean thousands in monthly savings and lakhs over the life of the loan. If you already have a home loan, review your current interest rate. Talk to your bank. Understand how your EMI changes. And if you’re planning to take a loan, this could be the perfect time to lock in a low rate.

Your home loan EMI after repo rate cut is more than just a number—it’s your chance to reduce your financial burden, repay smarter, and save more in the long run.